Out-of-Home Market

Espresso Coffee Machine

Your source for insights on the out-of-home coffee machine market

Gain advanced insights into the Out-of-Home Espresso Coffee Machine Market with cutting-edge research. Our approach is designed to provide a level of depth and granularity in data that transcends traditional market reports.

CoffeeBI’s Advanced Out-of-Home Espresso Coffee Machine Market Analysis offers unparalleled insights for businesses navigating the complexities of the away-from-home coffee machine market.

Tailored Research

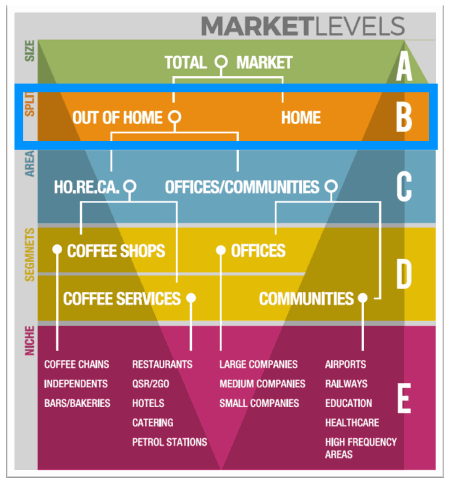

In contrast to generic one-size-fits-all reports, we prioritize precision and customization to meet diverse business objectives effectively. Our method begins by meticulously specifying the country, laying the foundation for a comprehensive analysis. Delving into specific market segments, we recognize the importance of nuanced understanding, differentiating Horeca vs Offices/Communities. Further granularity is provided through sub-segment divisions, including Cafes, Restaurants, Hotels, Offices, Airports, Railways, and more.

Strategic Advantage Tailored to Your Business

CoffeeBI is more than just a source of data; we are your dedicated partner, empowering your business with a strategic advantage. Explore critical insights, covering sales volume and value, sell-in/ex-factory prices, market trends, and our recommended 3-year forecasts. Choose between a meticulously crafted, tailored report or expedited delivery in Excel table format through our special fast track service.

Flexibility for Your Unique Needs

Our flexible approach allows you to define your scope, modelling a report with the data that truly matters to your business. Customize your research with geographical areas, consolidation levels, and specific sub-segments, ensuring your strategic vision is supported by precise and relevant information.

CoffeeBI is your trusted partner in navigating the intricacies of the market. Elevate your business strategies with insights tailored to your unique needs and objectives. Explore the forefront of Out-of-Home Espresso Coffee Machine Market research with CoffeeBI – your strategic advantage in the competitive landscape.

Level B of in-depth analyses

Deliverables

Our output is not a pre-made report or a database extraction. We craft customized analyses aligned with client objectives, following a defined scope and methodology.