HORECA Market

Espresso Coffee Machine

Your source for insights on the out-of-home coffee machine market

Explore the Espresso Coffee Machine Market in-depth for the HORECA business. Our advanced research provides essential, granular data for a nuanced understanding of this dynamic industry.

Explore the Espresso Coffee Machine Market in-depth for the HORECA business.

Our comprehensive research goes beyond the typical market reports, offering in-depth and granular data that is essential for a nuanced understanding of this dynamic industry.

Navigating the complexities of the HORECA coffee machine market requires a focused approach, delving into the specifics of each country and analyzing individual segments in detail. Unlike one-size-fits-all reports, we recognize the importance of tailoring our research to your unique objectives.

Our methodology starts with pinpointing the country of interest and then drills down to the minutiae, ensuring a thorough examination of the market landscape.

Details of the analyses

CoffeeBI is your trusted partner in investigating key market metrics such as sales (both volume and value), sell-in/ex-factory prices, and market trends and forecasts spanning a suggested three-year period. Our approach extends to the breakdown of segments, distinguishing among Cafes, Restaurants, and Hotels.

Flexibility is at the core of our service. Once you define your research scope, we can tailor a detailed report that aligns with your specific data needs. Alternatively, opt for our special fast-track delivery to receive data in an Excel table format, providing you with quick and accessible insights.

Tailored to your needs

Discover the freedom to customize your research composition based on your unique requirements. Choose geographical areas, specify levels of consolidation, and pinpoint sub-segments to tailor the exploration of the Espresso Coffee Machine Market to precisely meet your business needs. Your journey into market analysis begins here, with CoffeeBI as your dedicated guide.

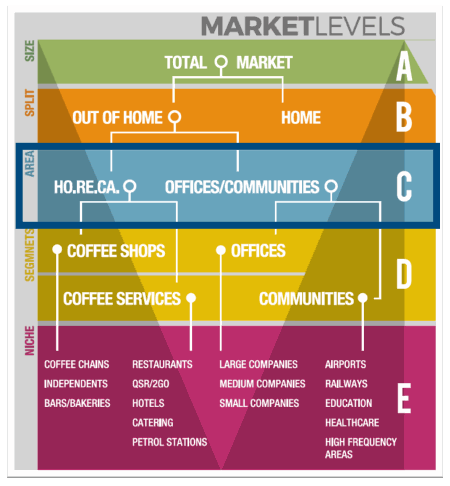

Level C of in-depth analyses

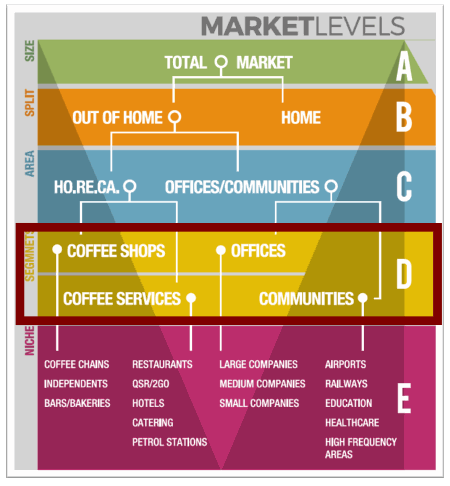

Level D of in-depth analyses

Deliverables

Our output is not a pre-made report or a database extraction. We craft customized analyses aligned with client objectives, following a defined scope and methodology.