The Professional machine market in the main European countries 2019 (Part 2)

Coffee machine manufacturers in Europe

Many of the world’s major manufacturers of professional coffee machines are located in Europe.

In Italy, traditional espresso machines are the most commonly manufactured, (those with groups), whereas in Switzerland and Germany the main manufacturers of fully automatic espresso machines and filter machines can be found.

These three countries represent over two thirds of the total world production of professional espresso machines, particularly in the higher price range.

Other major manufacturing countries are Spain, France, The Netherlands and Sweden. The main manufacturers of instant and filter machines are based in the Netherlands.

In recent years, some major players have been strategically acquiring other coffee machine brands to increase their market leadership. Competition is very high, and innovation is the key factor to maintaining and gaining market share.

Read also: The Professional machine market in the main European countries 2019 - Part 1

Europe

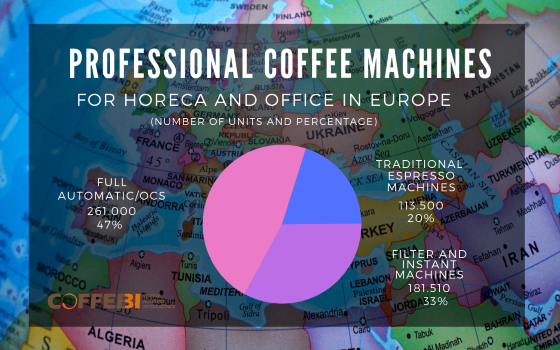

The European market for professional coffee machines for HORECA and offices has a SELL-IN value of 865 million euros and has recorded an average growth of 3.5% in recent years. The total number of professional machines sold in the old continent is around 556 thousand units.

The OCS (Office Coffee Systems) and super-automatic machines represent the majority (47%) followed by filter machines representing (33%) and traditional espresso machines (20%).

A large percentage of the market is concentrated in Western Europe, particularly in the top 5 countries, (Italy, France, Germany, Spain and the United Kingdom) which together represent 62% of the value. The remainder includes the other countries of Western Europe (27%) and Eastern Europe which represents the remaining 11% of the total market in value.

The sale of machines in the HORECA and office market has grown in recent years despite the difficulties in the European economy. The increase is mainly due to the opening of new cafes, coffee shops and “convenience stores” that require the purchase of new coffee machines. The hospitality and catering industry have increased investments and strengthened the professional machinery market, particularly in central, northern and eastern Europe. A big contribution to growth is also due to the use of table-top machines in the office. In particular, in medium to large ones, the refreshment corners have increased further with the availability of more coffee machines positioned in different areas of the workplace.

Prices for the machines have recorded a slight increase in recent years, particularly those of the medium-high range thanks to models with new designs and better performance.

The average selling price of a traditional espresso model in Europe is around 1,750 euros (sell-in). This price has increased on average by 1.0% / 1.5% in recent years. The widely used models are those with (two groups).

The average selling price for a fully automatic model is around 2,650 euros (sell-in) and the average for filter and instant machines decreases to less than half of this.

Prices for automatic machines have increased on average by 0.5% / 1.0% in recent years with a greater increase for medium-high-end models and a price reduction for the cheaper ones.

The super-automatic models most commonly purchased are those capable of delivering about 150-250 cups a day.