Professional coffee machines in Europe: Part 2

In recent years, the sale of professional coffee machines within the HORECA market is growing despite Europe’s economic troubles.

The increase is mainly due to the opening of new coffee shops and coffee points in shops and convenience stores, all of which have required the purchase of new coffee machines.

Don't forget to read the first part of this article here.

The hospitality and restaurant industry have increased investment in and strengthened the professional machine market, particularly in Central-Northern and Eastern Europe.

A large contribution to growth is also due to the use of table-top machines in offices. In particular, the number of refreshment corners has increased, even with the availability of more coffee machines situated in different points of the workplace.

The prices of the machines have seen a slight increase in recent years, those in the medium-high price range. This increase is because models with new design and better performance are emerging.

The average selling price of a traditional espresso model in Europe is around 1,750 euros (sell-in). This price has increased yearly by 1.0 –1.5% in recent years. The most widely used models are from two categories: the automatic model and the super-automatic model.

The average selling price for a fully automatic model is around 2,650 (sell-in), while that for filter and instant coffee machines is less than half that price.

The prices of automatic machines have increased yearly by 0.5–1.0% on average in recent years with a greater increase for the medium-high range models and a price reduction for the less expensive ones.

The super-automatic models that are in high demand are those capable of dispensing approximately 150–250 cups per day.

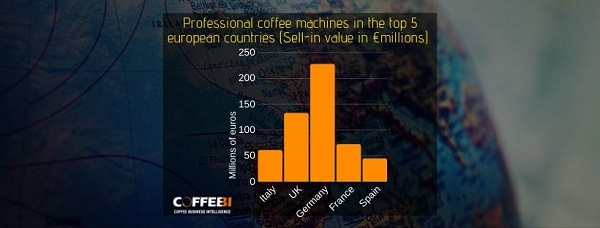

Professional coffee machines: leading European markets

Germany is the main coffee machines market in Europe, with a value of 227,5 million euros.

More about espresso coffee machines in Germany.

This value is generated by the large number of machines sold in the country and by the higher average price per single unit, as most models are super automatic.

There is strong competition in the country. costumer support and high performance from the coffee machines are required.

Italy is the market with the largest number of traditional espresso models. The producers mainly export their machines abroad and the domestic market has a sell-in value of 60.7 million euros.

The competition on prices and product quality make the Italian market one of the most competitive in Europe.

In France, the coffee machine market is shared between traditional and automatic models. The value is approximately 72 million euros (sell-in). Automatic models are used in offices, in the coffee shops of the main cities and especially in the north of the country.

Traditional models, thanks to local production, are also widespread in the suburbs. These models are preferred by the new cafés of the city centres.

Spain is the country that has experienced the largest market increase in recent years. Traditional espresso models have a large portion of the market compared to other machines. The average machine prices, however, are among the lowest in Europe.

Want you know more about a specific country? Contact one of our consultants

In the UK, despite concerns about Brexit, the market is still growing, thanks to the opening of new coffee shops and the increase in the use of automatic machines in the office. In terms of value (132.5 million euros), it is the second largest European market and average machine prices there that are among the highest in Europe.