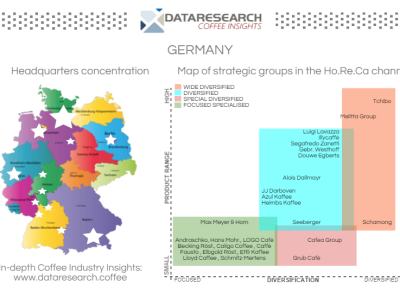

In a crowed scenario like the German market, the players try to difference their offer and production. In terms of global turnover, Tchibo GmbH is the absolute market leader and it’s activity is diversified, with coffee sector that covers more than 20% of the total revenues. The company sells other food and not food products through internet or through its

The German powerful: Product differentiation is a must