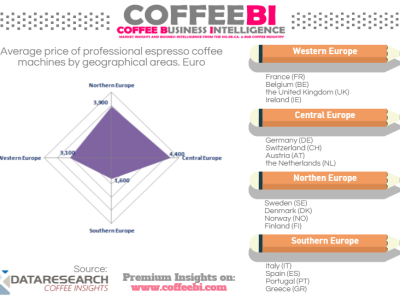

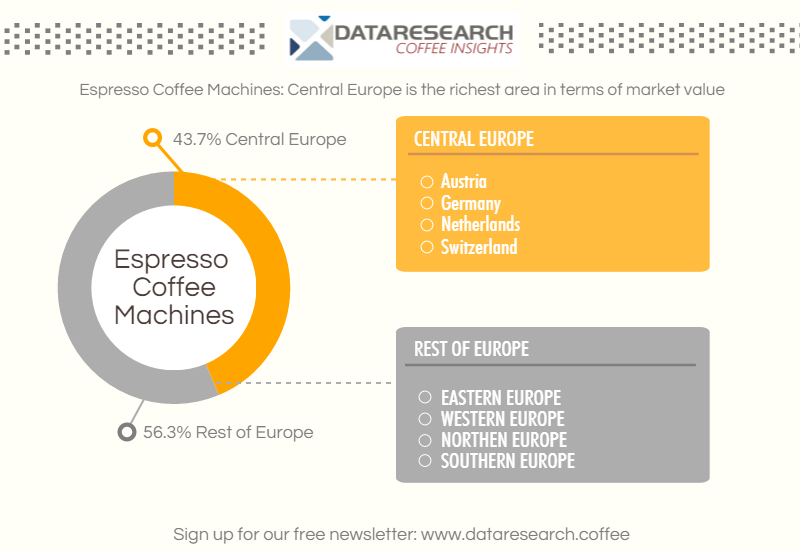

The different models (automatic or traditional) and the different cost of living in the countries lead the average price of espresso coffee machines among the European geographical areas. In Southern Europe the price of an espresso traditional coffee machine is around 1,600 euro, while in Central Europe, where fully automatic machines are mostly sold, the price is around 4,400 euro.

Professional Espresso Coffee Machines. Is the Price Right?