Germany: The HoReCa market for espresso coffee machines

Germany has the largest share of the coffee and coffee-machine market in Europe, followed by Italy, France and Spain. In terms of coffee consumption, it represents about 22% of the total European coffee market. The popularity of espresso-based drinks (cappuccino, caffè crèma and milchkaffee) has grown recently in comparison to consumption of filter coffee as a result of capsule and bean-to-cup machines becoming more widespread.

The hospitality industry accounts for about 223,000 businesses (increasing slightly), most of which include food service facilities (about 74%, increasing), followed by accommodation services (20%, decreasing) and, lastly, catering businesses and canteens (6%, increasing).

The top 20 coffee chains represent about 19.6% (2,360 units) of the total number of coffee shops. McCafé is the leader with a 35.6% share, followed by Tchibo with a 21.1% share and Coffee Fellows with 9.1%.

The German motor route network has around 14,500 petrol stations (the second largest in Europe after Italy), which offer both food and drink options. Bakeries comprise around 11,000 businesses (decreasing), 80% of which are micro-enterprises or small activities.

Professional coffee machines are produced internally or imported from neighbouring countries (Switzerland, Italy, the Netherlands and France in particular).

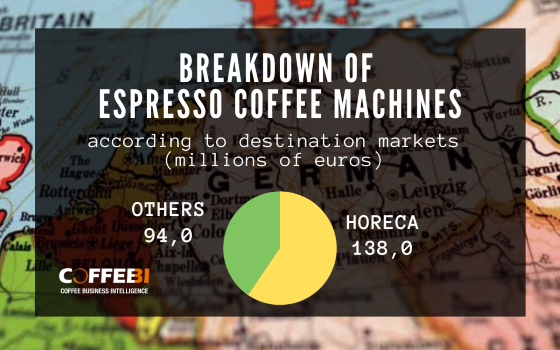

Espresso coffee-machine models represent about 75% of all professional coffee machines sold in the country. In 2018, espresso machines sold reached a value of 232 million euros (+6.9%).

This result is due to the good performance of fully automatic models, which recorded 5.4% growth, while sales of traditional espresso models decreased slightly by 0.8%. The HORECA market represents 59.5% of total coffee-machine sales in terms of value (138 million euros, +6.4% in 2018).

Contact CoffeeBI to know more about this analysis and its contents.