Covid-19 presents considerable downside risk to global coffee consumption

World coffee consumption is estimated 169.3 million bags, 0.7% greater than in 2018/19.

Consumption in Europe decreased by 0.6% while increased in the other regions, in particular in Asia & Oceania (+2.9%), Africa (+1.8%) and Mexico/Central America (+1.4%).

Increased also consumption in North America (+0.7%) while remained almost stable in South America.

Canada is one of the largest coffee consuming countries. Read how coffee in Canada evolves, the innovations in progress and consumer habits.

Covid-19 presents considerable downside risk to global coffee consumption.

The temporary closure of many businesses, especially in the out-of-home may contribute to the decline of coffee consumption and prices in 2020.

A further risk could be done by ample supplies, given that Brazil’s 2020/21 crop is in the on-year of its biennial Arabica cycle.

The ICO composite indicator continued its downward trend.

The New York Arabica futures market fell by 8.9% to an average of 106.69 US cents/lb in February 2020, while the London Robusta futures market declined by 3.3% to 59.02 US cents/lb.

Coffee Production slightly decreased

According to preliminary estimates published by the International Coffee Organization (ICO, February 2020), world coffee production in 2019 has decreased compared to last year (- 0,8%).

Total production in 2019 is estimated at 168,8 million bags, thanks to the increase recorded in the Asia & Oceania region (+5,4%) and in Central America (+ 1,6%, including Mexico). Coffee production in Africa (- 2,3%) and South America (- 4,7%) decreased.

Learn more about the coffee production in India and how the coffee market has evolved in recent years.

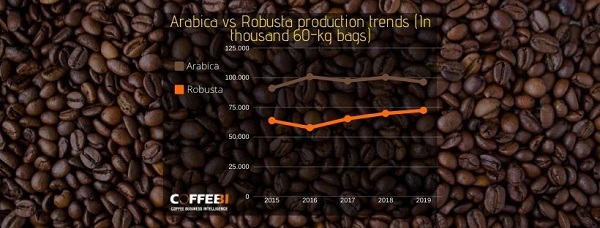

Arabica, with 96,3 million bags, underwent a significant drop quantifiable in -3.9% while Robusta production had an increase of 3.7% compared to 2018 (72,4 million bags).

Global exports decreased

Exports in the first four months of coffee year 2019/20 decreased by 5.8% to 39.53 million bags compared to 41.95 million bags in 2018/19. Shipments of Brazilian Naturals declined by 11.8% and Other Milds decreased by 6.6%.

South America’s exports declined by 9.8% to 19.86 million bags. During this period, shipments from Brazil fell by 12.7% to 13.16 million bags. Brazil’s exports of Arabica decreased by 17%, but its Robusta shipments grew by 22.4%.

Exports from Colombia rose by 1.5% while its output, as estimated by the National Federation of Coffee Growers of Colombia, has increased 12.9%. In February, Colombia launched the Coffee Price Stabilization Fund to protect farmers against price fluctuations. The goal of this new fund is to further improve the quality of Colombian coffee over time, but the full impact will likely be seen in the medium term.

Asia & Oceania’s coffee exports declined by 5.4%, in particular Vietnam exports (-14.6%) as low coffee prices discouraged farmers from selling their coffee, particularly with abundant supply from other Robusta producers. Declined also India’s exports (-8.4%) but its shipments of higher-valued soluble coffee have increased by 13.9% during this period.

Indonesia’s shipments increased 86.8% as its production recovered 16.8% from the previous year when output fell by 13.2%.

Exports from Africa increased 9.5% as shipments from the region’s three largest producers all increased. Uganda was the largest regional exporter (+10%). Shipments from Ethiopia grew by 18.2%, and from Côte d’Ivoire by 5.6%.

Exports from Mexico & Central America rose by 1.7% and this growth was led by Honduras where shipments grew by 2.6%.

Mexico’s exports have declined by 13.1%, partially in response to low prices, but also due to rising domestic consumption that reduces the availability of coffee for export. Among the other countries, Nicaragua and Guatemala recorded increases in exports.