In Europe the sale of machines into the HORECA and office markets has grown despite economic difficulties. The increase is due to a variety of different factors.

The Professional machine market in the main European countries 2019 (Part 2)

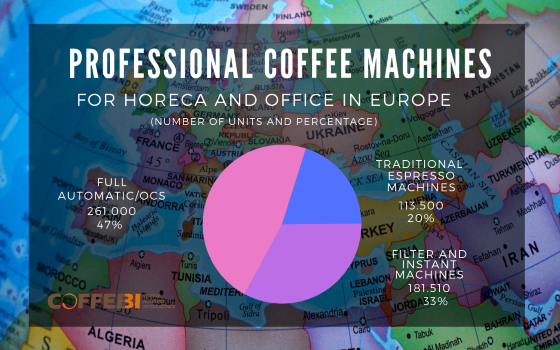

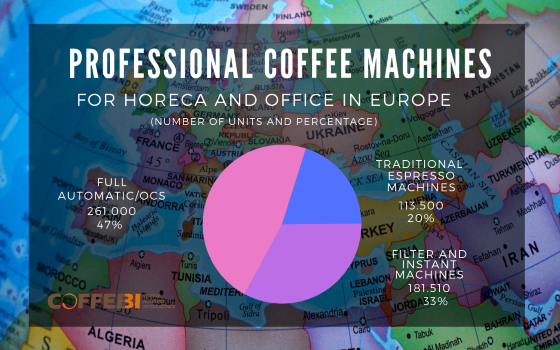

In Europe the sale of machines into the HORECA and office markets has grown despite economic difficulties. The increase is due to a variety of different factors.

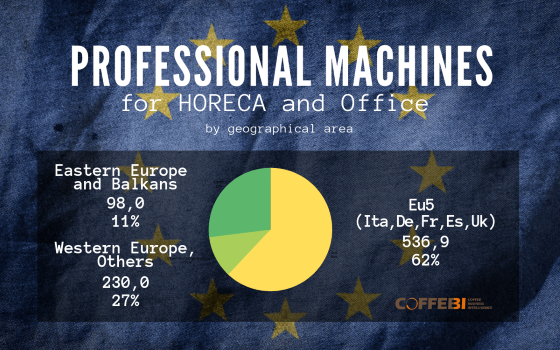

Which are the European countries in which the professional machine market is still growing? And what are the values of these markets?

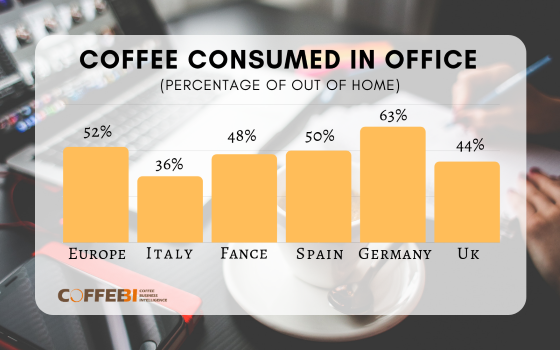

Some European countries show a very high growth in consumption in offices. In particular, a strong growth has been recorded in Northern Europe. Read more

In Europe, 52% of the volume of coffee consumed outside the home is drunk in the office, with very high peaks in the Nordic countries. Find out more.

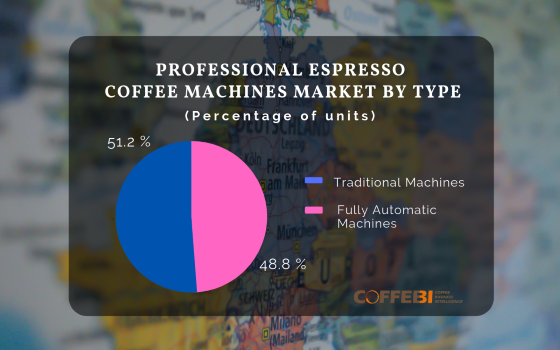

New analysis on Professional Espresso Coffee Machines estimates the European market at 215 thousand units with a value of 512 million euros (sell-in).

The European market has a value of 512 million euros at sell-in with an average growth of 4.0% in the last three years. Find out more.

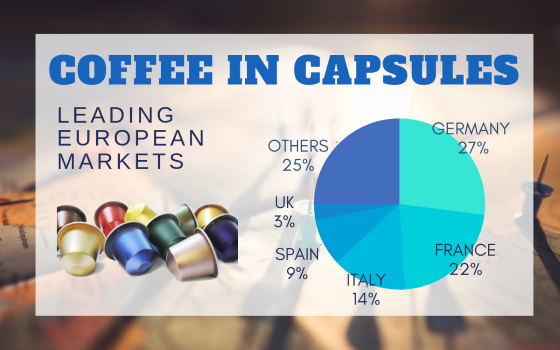

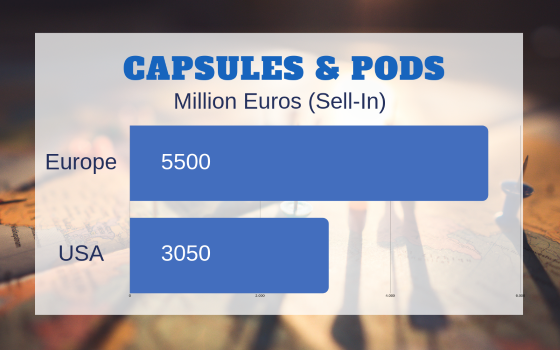

Coffee Capsules: What was the impact in terms of portioned coffee consumption in the main European countries?

In the last years capsules have had a great impact on the world of coffee, raising the competition and pushing operators to expand their range of offerings more and more.

In China, some market conditions are different. A low number of coffee shops compared to the population, especially in large towns, and the boost in coffee consumption (at two-digits) in particular out of home.

The hot coffee delivery is, therefore, a new opportunity to satisfy the large coffee demand.

At the moment, there is no available data to see if the delivery system will be appreciated by customers, the fact is that the giant coffee chain Starbucks is also moving towards signing a partnership with Alibaba, China’s largest online retailer, to launch delivery services in September. The new deal will see Starbucks integrate a “virtual store” in online shopping and payment apps.

The hot coffee delivery model, launched by the Chinese company Luckin, is fueling the debate among operators: May this new model change coffee habits?

As explained by Qian Zhiya, Luckin Coffee founds its business model starting from some weak points of coffee shops in China: high prices and lack of presence. “In western countries, the price of a cup of coffee consists of only 1/1,000 of people’s monthly income. In contrast, it is almost 1/100 for people living in China”. “Also, the number of coffee shops in the mainland is very limited. As opposed to Taiwan, where the population of 23.5 million enjoys over 5,000 CITY CAFE shops (a brand launched by 7-Eleven), there are only 300 Starbucks stores in Beijing, a city populated with 29 million people”. Find out more about Luckin.