Exploring Coffee Shop Culture in Russia

Russia is a country more frequently associated with a tea drinking culture which dates back hundreds of years. While the hot drinks market in Russia is still dominated by tea, the consumption of coffee is one the rise, with the consumption of fresh coffee being the main driver (ICO, 2015). The coffee market was valued at around $2.5 billion in 2014 compared to around $4 billion for tea (USDA 2014).

‘Specialty coffee is new in Russia; until just 20 years ago, any form of coffee had been considered a luxury reserved for the elite and was far beyond the reach of average consumers. Today, half of all coffee consumed is still soluble (instant) coffee, making it one of the biggest markets for Nescafe in the world. The other half of is a hodgepodge of commodity and specialty coffee’ (Hetzel, 2012: 32).

Although it is the consumption of tea ingrained in Russian history, coffee consumption has been present since the era of Peter the Great once it was brought back from Holland in the 18th century, with the first coffee house, the Four Frigates, opening in St Petersburg in 1720.

In terms of coffee consumption Russia is much lower than many of the European coffee drinking countries, although it has been rising in recent years with consumption at just over 4 million bags in 2014 (around 120 cups per person) which is twice that experienced in 2000 (IC0, 2015). In 2012 coffee house chains experienced a 26% growth in value as well as 16% growth in the number of outlets, in part driven by a growing coffee culture among consumers, but more broadly around a coffee house culture developing particularly among the more affluent urban consumers. In 2014, Euromonitor placed Russia in 5th place for growth in coffee shops in term of value growth 2008-2013) with US$507 million, behind USA, South Korea, China and the UK.

While in many countries where the café market is rapidly expanding in part due to a rise in having ‘coffee to go’ out of the home, in Russia there is still a preference for consuming tea and coffee in a café, often with food. As a consequence, many coffee shops in Russia provide substantial seating areas as well as a range of food and drink options. It was estimated in 2014 that drinks only accounted for around 60% of sales in Coffee House, Costa Coffee and Traveller’s Coffee and only 43% in Shokoladnitsa (USDA, 2014). The typical Russian café format differs from western standards too as Russian consumers prefer wider range of drinks and food items.

Market Leaders

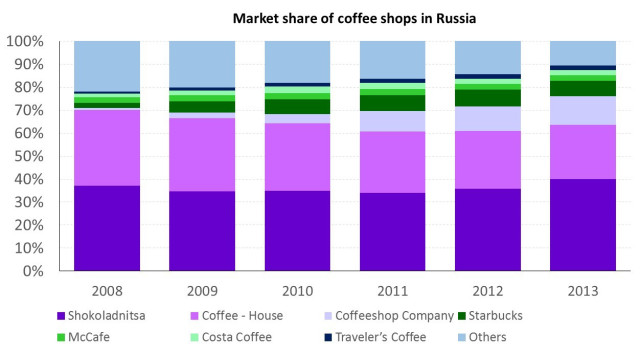

The growing café culture has been evidenced by the rapid expansion of cafes (both chains and independents) across the country with estimates of about 5,200 in 2014 (USDA, 2014). While it is estimated nationally there are around 2 cafes per 100,000 people, this is significantly higher numbers in cities such as Moscow and St Petersburg where coffee shops are concentrated [1]. However, the rapid development of shopping centres, business centres and trade centres across the country has allowed many chains to expand into other regions of the country outside of the dominant urban centres.

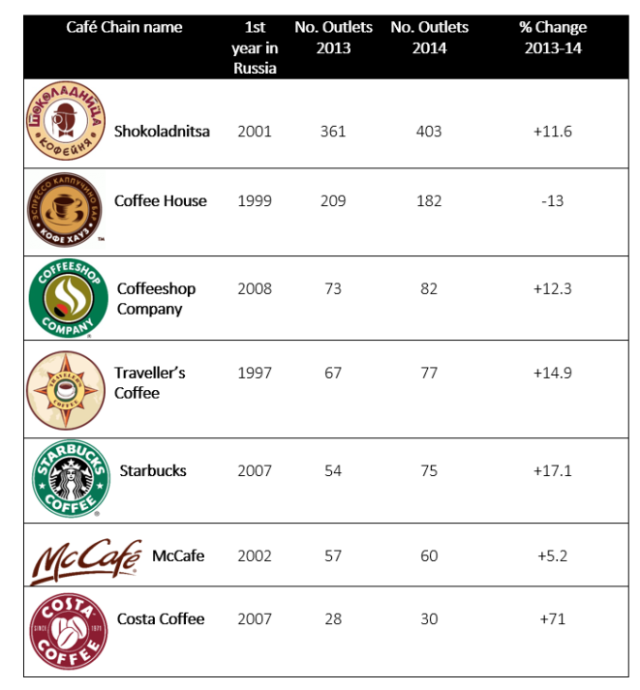

Alongside the global brands of Starbucks and Costa Coffee which have sought to make a stamp on the Russian café market, there are a number of domestic chains which dominate the coffee shop landscape, as shown here:

- Shokoladnitsa is one of the largest and oldest café chains in Russia with its first outlet in Okytabrskaya metro station opening in 1964. As one of the leading café chains it not only has a vast network of outlets in Moscow and St Petersburg but has expanded across the country and across into other countries in the region including Azerbaijan, Kazakhstan and Ukraine. In 2012 Shokoladnitsa was thought to have around 17% of the coffee shop market and Coffee House 14% (Food and Drinks Market, 2012).

- Coffee House is another chain with a network of outlets across the country. The company which owns Shokoloadnitsa (Gallery Alex OOO) also bought the Coffee House chain, but it still operates under the original branding.

- Both Shokoladnitsa and Coffee House have been developed in cities through owned outlets and franchises; these two market leaders together represent around 7% and 5% respectively (USDA, 2014). While both have become well known café chains they have some differences with Shokoladnitsa styling itself more on the Italian type café with Coffee House has more similarities to an American style coffee shops. As a result the consumer base for each differs too with Shokoladnitsa being more popular with those aged under 30, and Coffee House being frequented by a more mature audience. A key factor in the growth of these café networks has been the expansion of shopping malls and business centres where these companies initially focused their activities.

- Coffee Shop Company, an Austrian chain entered Russia in 2008 and is ranked third in terms of coffee sales (USDA, 2014) it has an expanding network of outlets, concentrated in St Petersburg,

- Coffee Bean was considered one of the pioneers of café culture in Russia with its first store in 1996. It was a barista in Coffee Bean, Rafael Timerbaev who invented the drink the ‘Raf’ which is a drink you may now see on many Russian coffee shop menus, and heralded by some as one of the most popular coffee based drinks. The ‘Raf is a drink generally made with an espresso, sugar (sometimes vanilla sugar) and cream which has all been steamed in a cup (Afanasyeva, 2016).

- Coffee Mania opened in 2001 and is considered more expensive than some of the other café chains but was the first to being to roast its own coffee beans and to introduce more ‘third wave’ brewing methods such as Chemex.

- Starbucks entered into Russia in 2007 and like in most countries it has expanded to it has developed ‘localised’ products such as tomato bread sandwiches, and custard buns.

- Traveller’s Coffee was established by a former music producer form the US, and has grown from one small coffee counter to over 60 coffee shops in 37 cities, as well as its own roaster in Novosibirsk (Think Russia, 2014) which sets it apart from many other cafés.

- Costa Coffee was the second international chain to enter into Russia. It did so by partnering with a Russian Restaurant group, Rosinter, who facilitated the re-branding of a chain of cafes previously known as Moka Loka. Costa aimed to appeal to Russian consumer preferences by staying open later in the evening, and adding alcohol to some coffee drinks, and had an ambitious plan for expansion in Russia (Wiggins, 2008).

- McCafe, the café arm of the global fast food giant McDonalds has a growing number of outlets in the country, again with a concentration in the Moscow region, but gradually expanding in other regions.

- Russia is also the home of an international café chain ‘Ziferblat’ were customers pay not for the goods they consumer but the time they spent there (Think Russia, 2013). Part of a number of ‘free-spaces or anti-cafes in Russia, Ziferblat first opened in Moscow in 2011 but now has branches in many cities, both in Russia and across Europe (Flintoff, 2013).

Specialty Coffee

- While the café market in large cities is dominated by these chains – approximately 60% by the large chains such as Shokoladnitsa and Coffee House, 20% by smaller chains like Costa Coffee, Coffee Mania – the remaining 20% falls to independent cafes (USDA, 2014). Alongside these chains, it is the activities of many local independent specialty coffee stores which are contributing to a growing coffee culture. While instant coffee still dominates the coffee consumption habits of Russian consumers, there is a growing demand for high quality fresh coffee [2].

- Some of the more well-known specialty cafés in Russia, with a concentration in Moscow, include: the Akademija Specialty Coffee, West 4 Coffee Brew bar; Double B Coffee and Tea, Red Espresso; Kofein (which began as a doughnut and coffee chain but has morphed into a premium coffee chain where you can now have a range of brew methods), Bean and Leaf (which roasts its own beans) and Les, a chain in which some outlets act as a café and co-working space.

- An emerging specialty coffee market is present in St Petersburg too with cafés such as Bolshe Coffee with an in-house roaster, City Coffee which was named Russia’s best coffee house in the 2014 Russian Coffee Cup awards and Coffee 22 where coffee and music are brought together, and Espresso Bike which began its life as a coffee bar powered by bicycle but now has its own café space. These cafés and more are explored in an article by Darya Afansyeva on Sprudge.

- As with the growth of specialty coffee in many countries around the world, alongside the emergence of independent cafes and café chains there is also the development of roasting facilities both in-house for some cafés, as well as independent roasteries too. For example Camera Obscura in Moscow, and then on a much larger scale Soyuz Coffee Roasting based in Leningrad, now one of Russia’s leading specialty coffee producers (Welch, 2016). While Russia may not have the concentration of specialty coffee cafés as some European cities, the specialty coffee industry in this region is growing, with increasing cafés, roasters, training courses for baristas and coffee related events.

The Future

- The popularity of cafés is predominantly with urban consumers with many café companies concentrating their efforts in the largest cities, Moscow and St Petersburg. Mojtaba Akhbari of Starbucks has commented that “Moscow, with its vibrant economy and cosmopolitan culture, is the right place to start in Russia. For a market with a quickly emerging and upwardly mobile middle class, Moscow has a low concentration of cafes” (Antonova, 2008).

- Some reports suggest that even though the popularity of coffee has been increasing in recent years the ICO suggests potential for substantial growth remains limited (ICO, 2015). The trend for increases in visiting cafes relies on a customer base with enough disposable income, which in turn relates to the wider economic conditions in the country. With significant economic instability, decreased consumer purchasing power and growing competition the prospects for continued rapid expansion of café chains in Russia remains mixed.

- While growth of the café industry in Russia to date has been concentrated in cities of Moscow and St Petersburg, expansion beyond these regions represent significant opportunities given a much lower ratio of cafés to consumers.

- Although specialty coffee cafés are a niche part of the café market they are growing and are a key component of the growing coffee culture in Russia.