Europe post-pandemic and the future of coffee away from home

Several months after the onset of the Covid-19 pandemic, numerous economic activities, related to the out-of-home market, have been affected by a reduction in customer numbers and more restrictive regulations in terms of space and opening hours, with a consequent loss of turnover.

Following a brief recovery during the summer months, the situation has far from recovered, and analysts predict that only from the spring of 2021, will it be possible to evaluate the overall effects and reschedule any activities.

From a global perspective, the effects of the health and economic crisis could continue throughout next year in some areas of the world, due to the different phases of evolution of the pandemic, and the various measures adopted by governments to limit its impact.

As for coffee consumption, if on the one hand, the pandemic has caused the collapse of the away-from-home market, on the other hand, there has been an increase in the consumption of coffee within the home.

In recent months, figures have shown an increase in the sales of coffee and coffee machines for the home. Interesting is the greater attention to quality and the demand for selected blends, with the aim of reproducing the same quality of coffee as in coffee shops.

If, therefore, the initial results of the main coffee roasters do not appear negative, the situation with regard to the out-of-home operators is totally different.

Despite the adjustments to the new rules regarding social distancing and the cleaning of premises, losses were inevitable, due primarily to the fall in customer numbers.

Bars, restaurants, hotels and also vending operators have recorded heavy losses. Many small businesses are at risk and there is the threat of unemployment within the sector.

Here are the trends, developed by COFFEEBI, in relation to coffee consumption away from home within the major European countries.

The trend of coffee consumption away from home in Europe

Europe represents the largest area in terms of coffee consumption away from home, followed by North America and Asia.

In 2019, before the pandemic, coffee consumption in Europe recorded a growth in value of 2.1%, by comparison with 3.8% in North America and 7% in Asia.

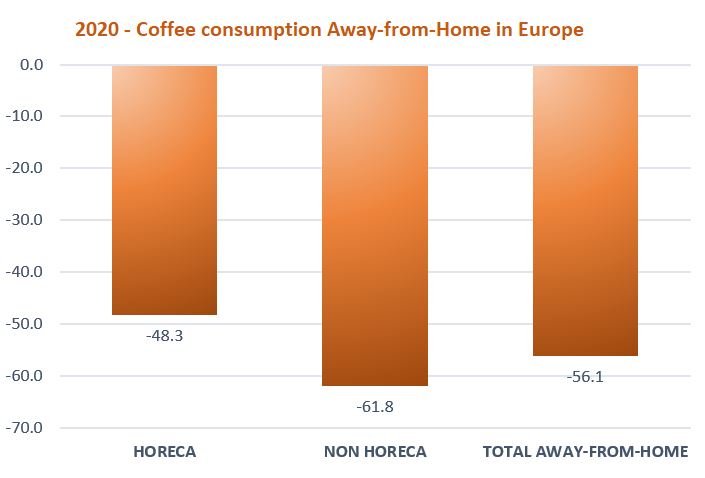

At the end of 2020, it is predicted that the sales of coffee away from home in Europe will record a sharp decrease (-56.1%). Growth is expected in 2021, mainly due to the recovery of businesses in the second half of the year, however, to return to pre-crisis levels, it will be necessary to wait until 2022.

The most significant losses will be associated with the consumption of coffee in the office (-61.8%) as an effect of the remote-working policies widely adopted in many European countries. HORECA consumption is expected to decrease by 48.3%

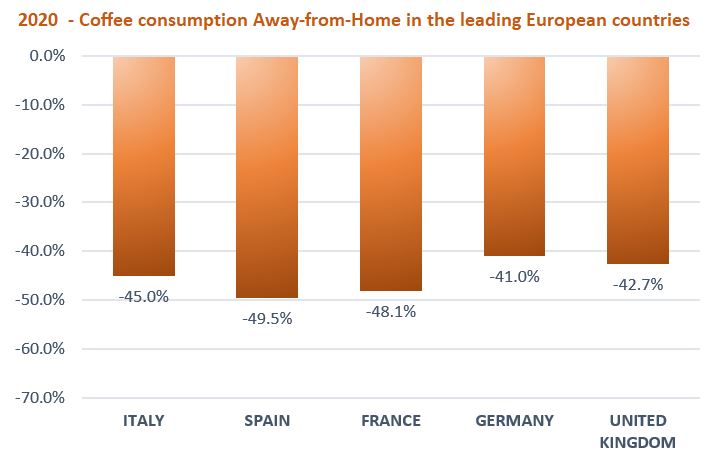

Slightly less than average losses are expected in certain northern European countries, supported by the initial, less restrictive policies adopted by local governments, while the most significant losses will be recorded in Eastern European countries.

At the end of 2020 in Italy, an average drop in value of 45% is expected in coffee consumption away from home. Compared to other major countries, the very restrictive, initial policies that led to the complete suspension of activities for several months, will have a greater impact on HORECA, while the decrease in consumption in the office will be slightly more contained than the European average.

In Spain, the decrease in coffee sales will be close to 50%, while in France, the initial, more permissive policies regarding closures and opening hours have slowed down the decrease in consumption within HORECA. The drop in consumption in the office will have the greatest impact on the annual trend of the away-from-home market (-48.1%), due to large-scale remote working.

The coffee market in Germany is the largest in Europe. In 2019, the consumption of coffee away-from-home recorded a 2.5% increase in value, with an even greater increase in the office segment. In 2020, the reduction in consumption is expected to be 41% in value. The loss will be greater in the office segment, due to the strict home-working policies adopted, while HORECA has been affected by restrictive, regional regulations and also as a result of the increase in takeaway coffee sales.

Despite the uncertainty related to “Brexit”, the coffee market away from home in the UK continued to grow until 2019 (+ 2.9% in value). In 2020, restrictions on the operation of many facilities are expected to have resulted in a 42.7% reduction in coffee consumption outside the home. The greatest losses will be recorded in the offices, while the decrease in sales in the HORECA industry will be partially mitigated by the widespread use of take-away coffee and by the increase in delivery services.

The future of coffee away from home

Based on COFFEEBI forecast trends, only at the end of 2022 should the values of coffee consumption outside the home return to pre-pandemic levels.

For the operators it is unthinkable to wait until then or to trust in government interventions, as it could be late.

Regardless of the duration, the pandemic is changing the times and places of the coffee break and, as with any change, there is a need to adapt and find new solutions.

Each change generates new opportunities for operators who will be able to innovate, not only in terms of products, but above all in relation to services and business models.

In the coming years, certain key points will have to be considered:

- people will not drink less coffee than before, but will drink coffee at different times and in different places;

- it will be necessary to rethink the way in which coffee has been served until now;

- overcrowding must be avoided while maintaining high standards of hygiene.

Macro-changes could affect workplaces, with many more people staying or preferring to stay and work in smaller towns, rather than large city centres.

In this case, for example, independent or local bars would play a fundamental role and would see opportunities increase. However, it will be necessary to innovate the offer, with quality products for more demanding customers; the possibility of providing a delivery service, at least within a predefined area, should also be considered.

There will be opportunities for machine manufacturers, who are already innovating, by offering “no-touch” solutions. Such manufacturers could benefit from the increase in micro-refreshment points, offering new ad-hoc solutions.

New opportunities will open for “micro markets”, with the offer of ready meals and food and drink for people working from home, or in areas where bars and restaurants are scarce.

Therefore, there are no perfect solutions or secret formulas to overcome crises. Only by observing and listening to the market can decisions be made to innovate and address the key challenges awaiting us in the near future.

Contact COFFEEBI to know forecast trends on segments, markets and our methodology.